Brand-based finance is a term that appears more and more in conversations about payments, loyalty and customer experience. Yet it is often misunderstood or overcomplicated.

At its core, brand-based finance is a simple idea: keeping value, data and trust where the customer relationship already lives, inside the brand ecosystem.

The traditional model

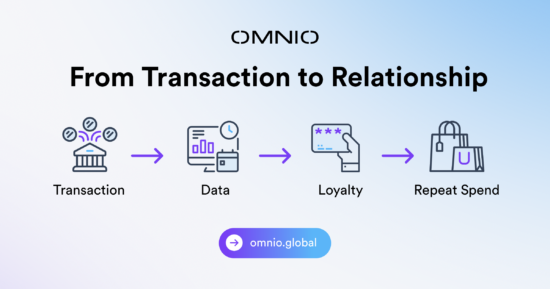

In traditional payment models, value flows outwards. Transactions are processed by multiple intermediaries, data is fragmented and the brand has limited visibility or control beyond the point of sale.

Loyalty programmes, where they exist, often sit separately. Rewards are delayed, disconnected from the moment of purchase and managed through different systems.

This creates friction for customers and missed opportunities for brands.

What brand-based finance changes

Brand-based finance brings selected parts of the payment journey back into the brand’s own environment. This does not mean becoming a bank. It means using embedded financial capabilities to design payment and value flows that align with the brand’s relationship with its customers.

Payments, loyalty and value are connected. Data is unified. Rewards can be issued instantly. Customers remain within the brand experience rather than being pushed out of it.

Why brands are moving this way

There are several clear drivers behind the shift.

First, cost. Reducing fees and retaining more value within the ecosystem is increasingly important in margin-pressured markets.

Second, insight. When transactions and loyalty sit together, brands gain a clearer, real-time view of customer behaviour.

Third, experience. Brand-based finance allows brands to reward customers at the moment it matters, not days or weeks later.

What customers experience

From the customer’s perspective, brand-based finance feels simple.

- They pay as they normally would.

- They see rewards appear instantly.

- They understand the value they’ve earned.

- They can use it easily.

There is no need to download another app, scan a separate card or wait for something to happen later. The experience feels natural and integrated.

What brand-based finance is not

- It is not about locking customers in or limiting choice.

- It is not about replacing open-loop payments entirely.

- It is not about adding complexity.

In practice, many brands use a hybrid approach, combining open-loop reach with closed or controlled value flows where it makes sense.

A foundation for what comes next

As AI-driven personalisation becomes more common, the importance of unified data will only increase. Brand-based finance provides the structural foundation that allows intelligent experiences to operate responsibly and effectively.

For brands thinking about the future of payments, loyalty and customer engagement, brand-based finance is less a trend and more a shift in mindset.