Omnio Pay

Transform your customer experience

Omnio Pay is our white label digital wallet and payment solution that empowers trusted consumer brands to quickly plug financial products into their existing digital channels.

BUSINESS BENEFITS

Unlock new revenue and boost brand loyalty

The financial products your customers want, when they need them. Allow your customers to receive, hold and spend funds directly within your brand’s ecosystem and make it easier for your customers to spend, shop and stay loyal.

Generate new revenue streams

Boost your revenue by earning fees, commissions and revenue sharing on financial products.

Improve your customer experience

Keep customers engaged by offering financial products when they need them and stop them leaving your channels for third-party providers.

Increase average basket size

Simplify purchasing for your customers with innovative and flexible payment solutions designed to enhance the checkout experience.

Lower costs

Streamline payment services, reducing costs and speeding up settlements by integrating your own system.

Increase customer loyalty

Retain loyal customers with a comprehensive range of financial services tailored to their needs.

Collect rich customer insights

Leverage valuable customer insights to personalise offers, target marketing and make data-driven decisions.

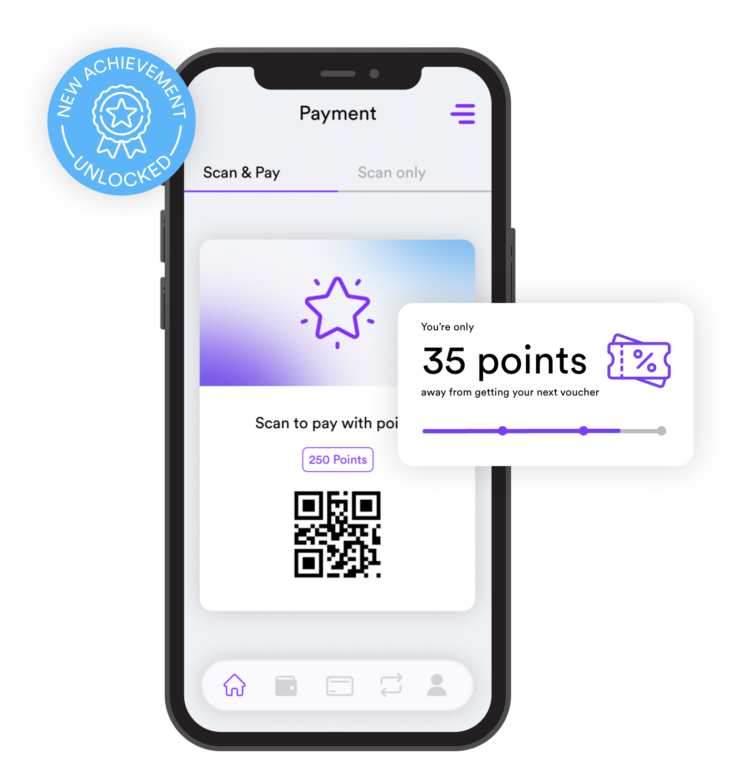

Enhance your Loyalty Programme

Integrate financial services into your loyalty programme, making it easier for your customers to earn, redeem and manage their rewards whenever they make a purchase.

Incentivise your customers with flexible lending

Embed flexible payment solutions into your digital experience, offering your customers more choice at checkout without leaving your channels.

Engage customers and boost profits

Use loyalty and rewards to engage customers, increase sales, generate new revenues and lower costs by using closed-loop payments whenever your customers spend with you directly.

Quick time

to market

Omnio Pay is offered as a plug-in to your existing channels. Our interfaces are already tested and certified, allowing you to customise and launch 4X faster than the average Banking-as-a-Service integration.

How does it work?

Introducing Omnio Pay, the digital payment wallet that seamlessly integrates with your existing loyalty programme, enhancing its value and benefits.

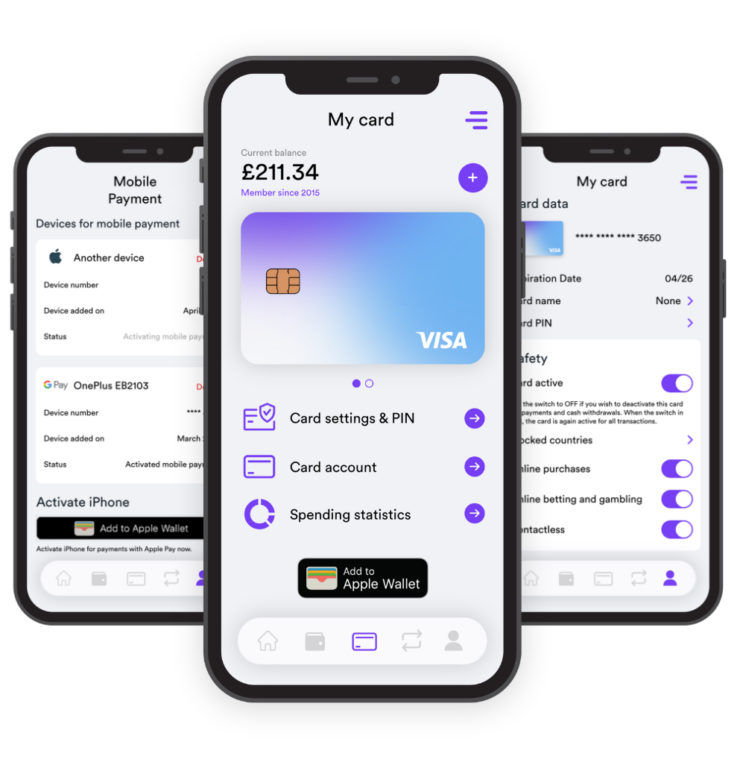

With Omnio Pay, loyalty accounts become more valuable than ever, by allowing customers to receive, hold and spend with your brand directly.

By providing branded digital payments cards, we introduce closed-loop payments, eliminating the need for customers to navigate to third-party payment platforms and lowering your cost of payments.

Customers can now conveniently spend with your brand, enjoying a seamless checkout experience and earning rewards automatically, instantly putting them to use.

Integrated flexible payment options incentivise customer loyalty with a more rewarding and convenient checkout experience.

Take customer engagement even further by offering more value-added products such as cashback on purchases, savings incentives, reward vouchers and gift cards. By doing so, you will not only deepen customer loyalty but also unlock new revenue streams for your business.

With Omnio Pay, you transform your loyalty programme into a powerful financial tool, driving customer satisfaction, increasing revenue and amplifying your brand’s success.

How does it work?

Customer Benefits

A more convenient customer experience

Customers enjoy the convenience of accessing financial services within the digital channels they already use, eliminating the need for separate providers.

Instant rewards issuance and redemption

Automatically reward your customers transactions with loyalty points that can be easily redeemed at checkout.

Greater access to financial services

Customers can access financial services like loans and payment plans, even if they have difficulty accessing traditional banking services.

Flexible payment options at checkout

Offer customers a more seamless checkout process with flexible payment terms that suit their needs.

Enhanced security

Customers can transact with peace of mind, thanks to robust security measures that protect their data.